Empowering Voters. Defending Democracy.

The League of Women Voters is a nonpartisan, grassroots organization working to protect and expand voting rights and ensure everyone is represented in our democracy. We empower voters and defend democracy through advocacy, education, and litigation, at the local, state, and national levels.

To become a League member, join one of the 750+ state and local Leagues.

Voting Tools

Register to vote, find your polling place, look up your ballot, and more at VOTE411.org.

In 2020, more than 6 million people found nonpartisan voting resources on VOTE411, including 2.2 million Spanish speakers.

Support the fight for everyone's freedom to vote.

Defending the Right to Vote

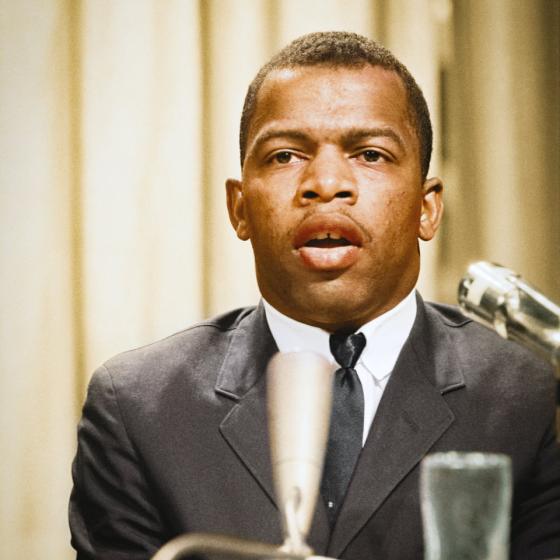

Urge Congress to Support the John R. Lewis Voting Rights Advancement Act

Contact Congress

Urge Congress to Address the Climate Crisis and Protect Our Youth

Contact Your Representatives

Support the Expansion of Voting Rights

Sign the Petition

Demand Equality in Our Constitution

Contact Your Representatives

Tell Your Senators to Pass the Disclose Act

Contact Your Representatives

Demand Bipartisan Cooperation on Voting Rights

Contact Your RepresentativesJoin Your Local League

to advocate for change at the local, state, and national level.

Defending the Right to Vote

In 2020 we protected more than 25 million voters in courts across the nation.

Keeping power in the hands of the people

The Republican-controlled North Carolina Legislature, asserting that state legislatures had exclusive power over redistricting, petitioned the Supreme Court for review, after the state supreme court struck down its redistricting plan.

Fighting for Lifesaving Abortion Care

LWVUS and nearly 100 other organizations joined an amicus brief arguing that the federal Emergency Medical Treatment and Labor Act (EMTALA) preempts Idaho’s abortion ban, which prohibits abortion in all instances unless necessary to save the life of the mother. EMTALA requires hospitals participating in Medicare to provide stabilizing care to any individual experiencing a medical emergency, regardless of their ability to pay.

Latest

Fighting Racial Gerrymandering

LWV of South Carolina and LWVUS filed amicus briefs at the United States Supreme Court supporting plaintiffs seeking affirmation of a three-judge panel ruling that found South Carolina’s first congressional district to be a racial gerrymander. The plaintiffs argued the state legislature violated the Fifteenth Amendment and Fourteenth Amendment’s Equal Protection Clause by dividing Black communities and voters among multiple districts to reduce their power to affect elections.

The Latest From The League

Sign Up For Email

Keep up with the League. Receive emails to your inbox!

Donate to LWV

Support our work to empower voters and defend democracy through a donation today!